Classic Cars / Oldsmobile / Car for sale

1986 Oldsmobile Cutlass

Sale price: $11,700.00 Make an offer

Car location: United States

Sale type: Fixed price listing

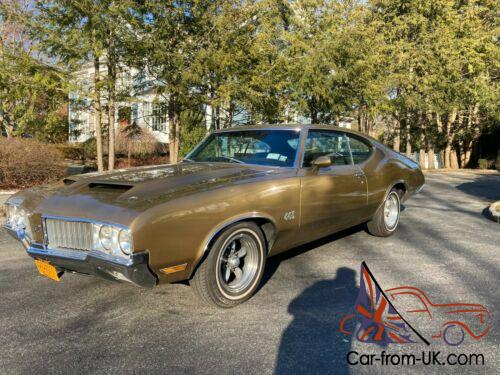

Technical specifications, photos and description:

- Make:

- Oldsmobile

- Model:

- Cutlass

- Year:

- 1986

- Type:

- Coupe

- Color:

- Black

- Mileage:

- 26,978

- Engine:

- 5.0 V8

- Transmission:

- Automatic

- Trim:

- Pinstripping

- Interior Color:

- Burgundy

- Vehicle Title:

- Clear

- Got questions?

- Ask here!

1986 Oldsmobile Cutlass for sale

Current customer rating:

This car is in mint condition.

My father purchased it from the daughter of an elderly lady who had bought it new at a local dealership. The daughter never used the car.

The car was totally serviced in 2012 with all new fluids. hoses and belts.

When my father purchased it he had a premier paint job done and put new tires on the car.

He has shown the car at multiple car shows and it always gets rave reviews.

He is only selling because he has 4 other antique/classic cars.

Serious buyers are welcome to inquire further with specific questions.

Truly a beautiful car!

My father purchased it from the daughter of an elderly lady who had bought it new at a local dealership. The daughter never used the car.

The car was totally serviced in 2012 with all new fluids. hoses and belts.

When my father purchased it he had a premier paint job done and put new tires on the car.

He has shown the car at multiple car shows and it always gets rave reviews.

He is only selling because he has 4 other antique/classic cars.

Serious buyers are welcome to inquire further with specific questions.

Truly a beautiful car!

Want to buy this car?

Comments and questions to the seller:

Other classic Oldsmobile cars offered via internet auctions:

price: $6,000.001972 Oldsmobile cutlass 442

price: $6,000.001972 Oldsmobile cutlass 442 price: $17,100.00Oldsmobile : 442 SX 455

price: $17,100.00Oldsmobile : 442 SX 455 price: $8,700.001969 Oldsmobile 442 442

price: $8,700.001969 Oldsmobile 442 442 price: $21,466.001964 oldsmobile cutlass all original classic car

price: $21,466.001964 oldsmobile cutlass all original classic car

Latest arrivals:

-

$7,270.000

-

$12,988.000

-

$199,800.000

-

$7,007.000

-

$10,100.000

-

$6,100.000

-

$9,500.000

-

$22,995.000

-

$10,100.000

-

$25,000.000

-

$44,999.000

-

$6,600.000

-

$111,000.000

-

$46,875.000

-

$10,100.000

-

$41,295.000

-

$6,300.000

-

$26,599.000

-

$10,001.080

-

$7,900.000